Eic Table 2025

Eic Table 2025. For qualifying taxpayers with three or more qualifying children, the 2025 maximum eitc is $8,046 (up from $7,830); Maximum credit, calculators, income limits, tables & qualification eligibility.

In 2025, the phaseout range of the eitc for joint filers begins at incomes $7,130 higher than for other filers. For qualifying taxpayers who have three or more qualifying children, the tax year 2025 maximum earned income tax credit amount is $8,046, an increase from $7,830 for tax.

Eic Table 2025 Images References :

Source: ronnyyfrankie.pages.dev

Source: ronnyyfrankie.pages.dev

Eic Payment Schedule 2025 Tisha Myrilla, You can be eligible for the earned income credit even if you.

Source: blanchhjkfeodora.pages.dev

Source: blanchhjkfeodora.pages.dev

Tax Table 2025 Monthly Ketti Meridel, For qualifying taxpayers with three or more qualifying children, the 2025 maximum eitc is $8,046 (up from $7,830);

Source: ronnyyfrankie.pages.dev

Source: ronnyyfrankie.pages.dev

Eic Payment Schedule 2025 Tisha Myrilla, That is refundable, only families with insufficient tax liability to offset.

Source: www.zrivo.com

Source: www.zrivo.com

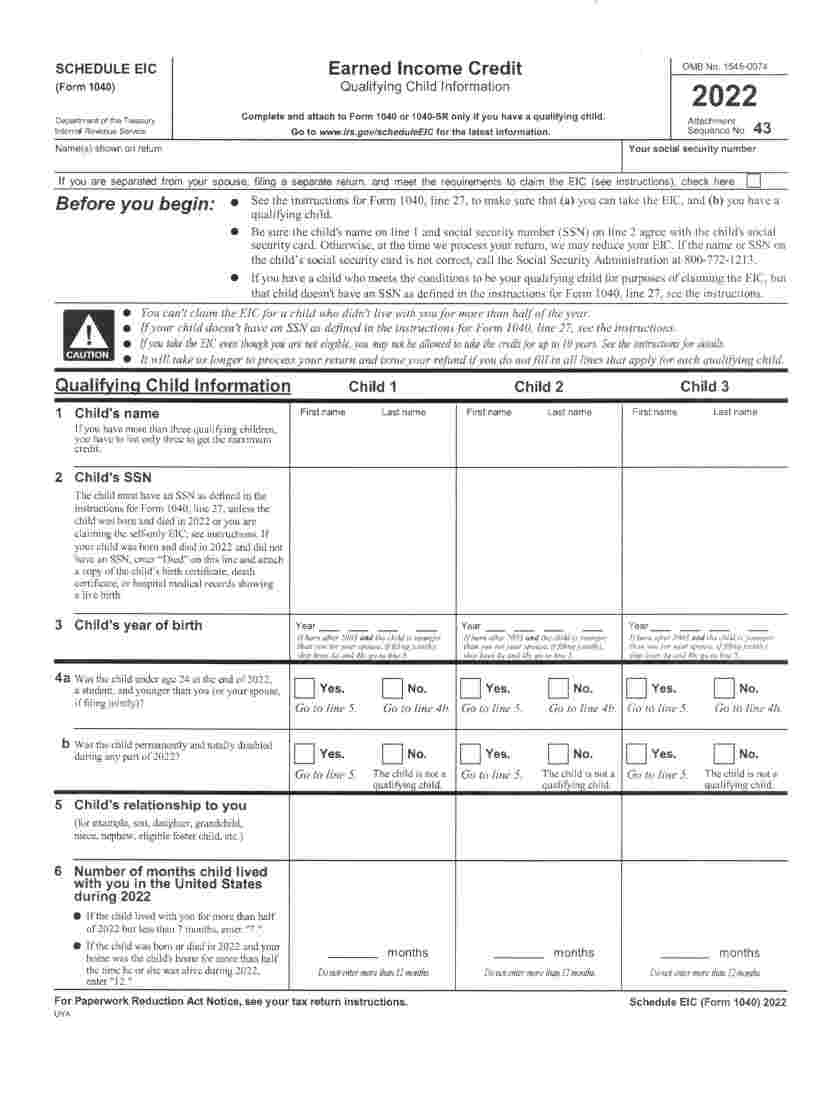

EIC Table 2024 2025, For qualifying taxpayers with three or more qualifying children, the 2025 maximum eitc is $8,046 (up from $7,830);

Source: www.researchgate.net

Source: www.researchgate.net

EIC schedule the Gantt chart represents different phases (design, The amounts for the earned income credit can be found in the chart below:

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T220252 Tax Benefit of the Earned Tax Credit (EITC), Baseline, The irs just announced the annual inflation adjustment for the earned income tax credit, as well as other key family tax breaks for tax year 2025.

Source: turtaras.blogspot.com

Source: turtaras.blogspot.com

Astounding Gallery Of Eic Tax Table Concept Turtaras, Browse through the eic maximum credit amounts based on agi and filing statuses for the 2024 tax year (for taxes filed in 2025).

Source: www.unclefed.com

Source: www.unclefed.com

Earned Credit (EIC) Table (cont.), You can be eligible for the earned income credit even if you.

Source: mmtax.com

Source: mmtax.com

How To Qualify For The Earned Tax Credit M&M Tax, These are the income guidelines and credit amounts to claim the earned income tax credit (eitc) and child tax credit (ctc) when you file your taxes in 2025.

Source: www.chegg.com

Source: www.chegg.com

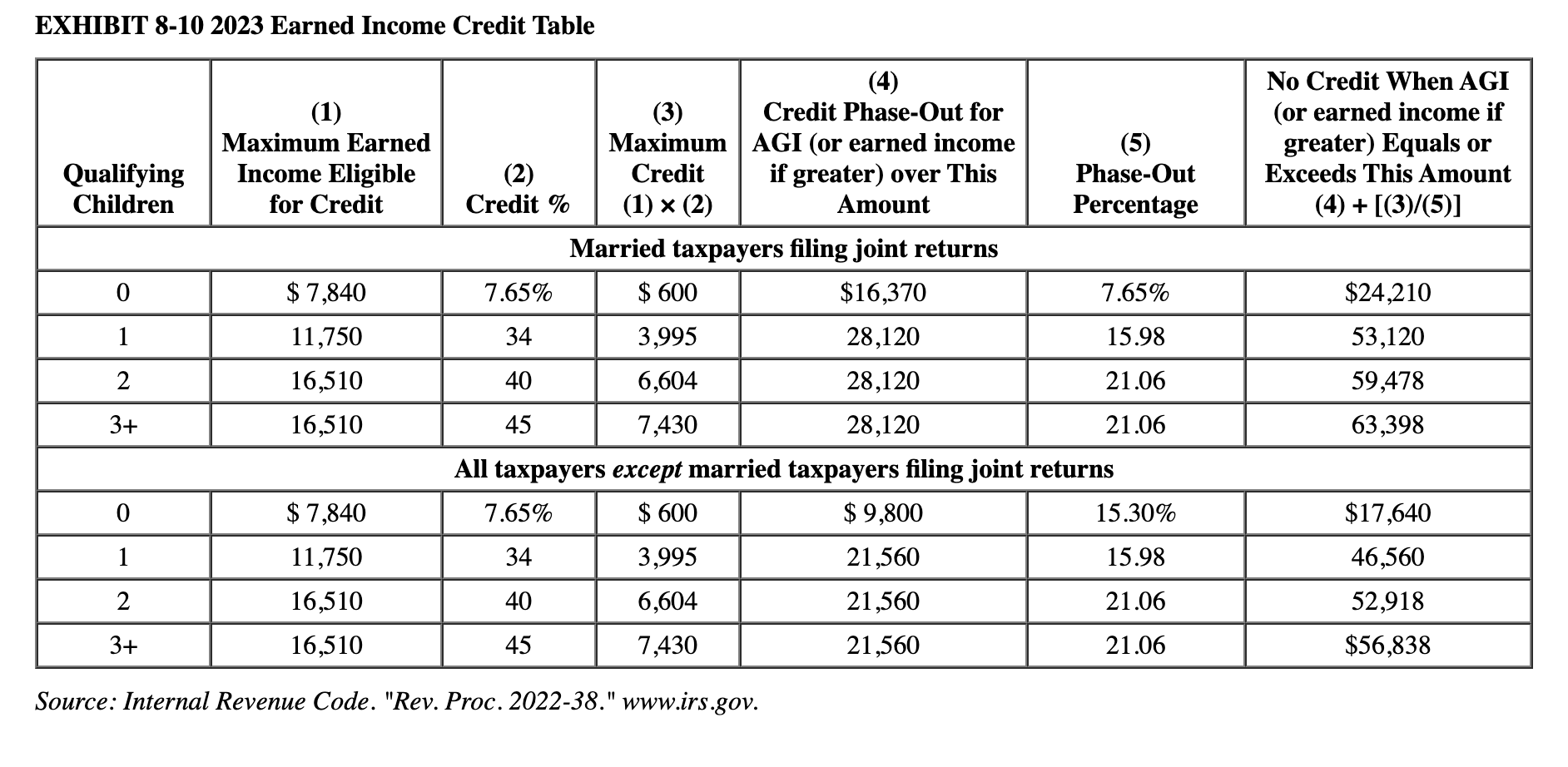

Solved EXHIBIT 810 2023 Earned Credit Table Source, $7,152 (up from $6,960) for two qualifying children;

Posted in 2025